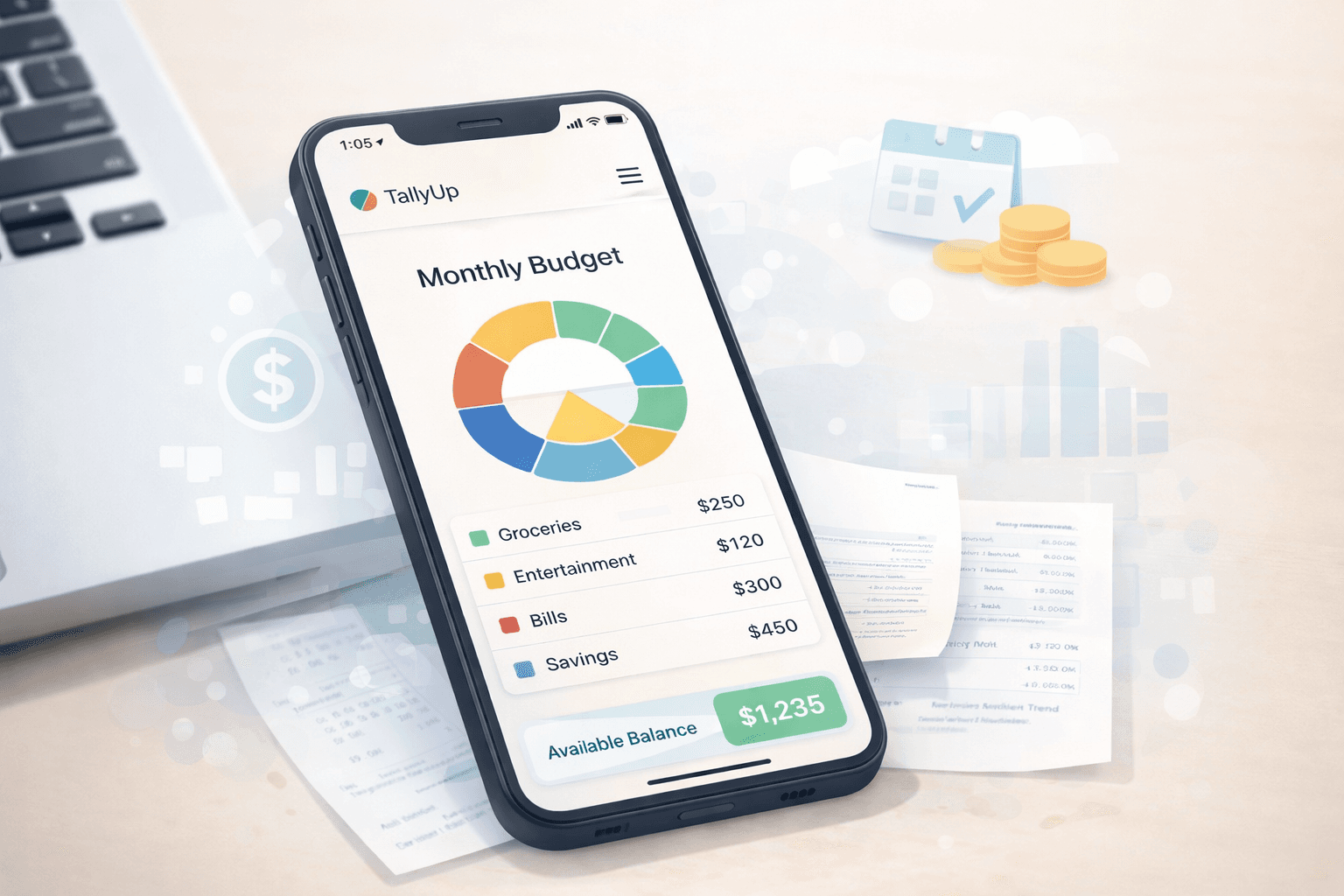

TallyUp

Turn financial ambiguity into clear choices.

TallyUp is a personal financial truth engine—an app that helps you build a clean, trustworthy picture of your money without requiring you to already be organized. It combines tracking, understanding, decision support, and readiness into one system.

The TallyUp Philosophy

One truth layer for every financial decision

Stop managing multiple spreadsheets, apps, and mental tallies. TallyUp creates a single, trustworthy picture of your money that you can actually rely on.

How It Works

From messy reality to actionable clarity

Capture

Manual-first entry ensures every transaction is real, not guessed.

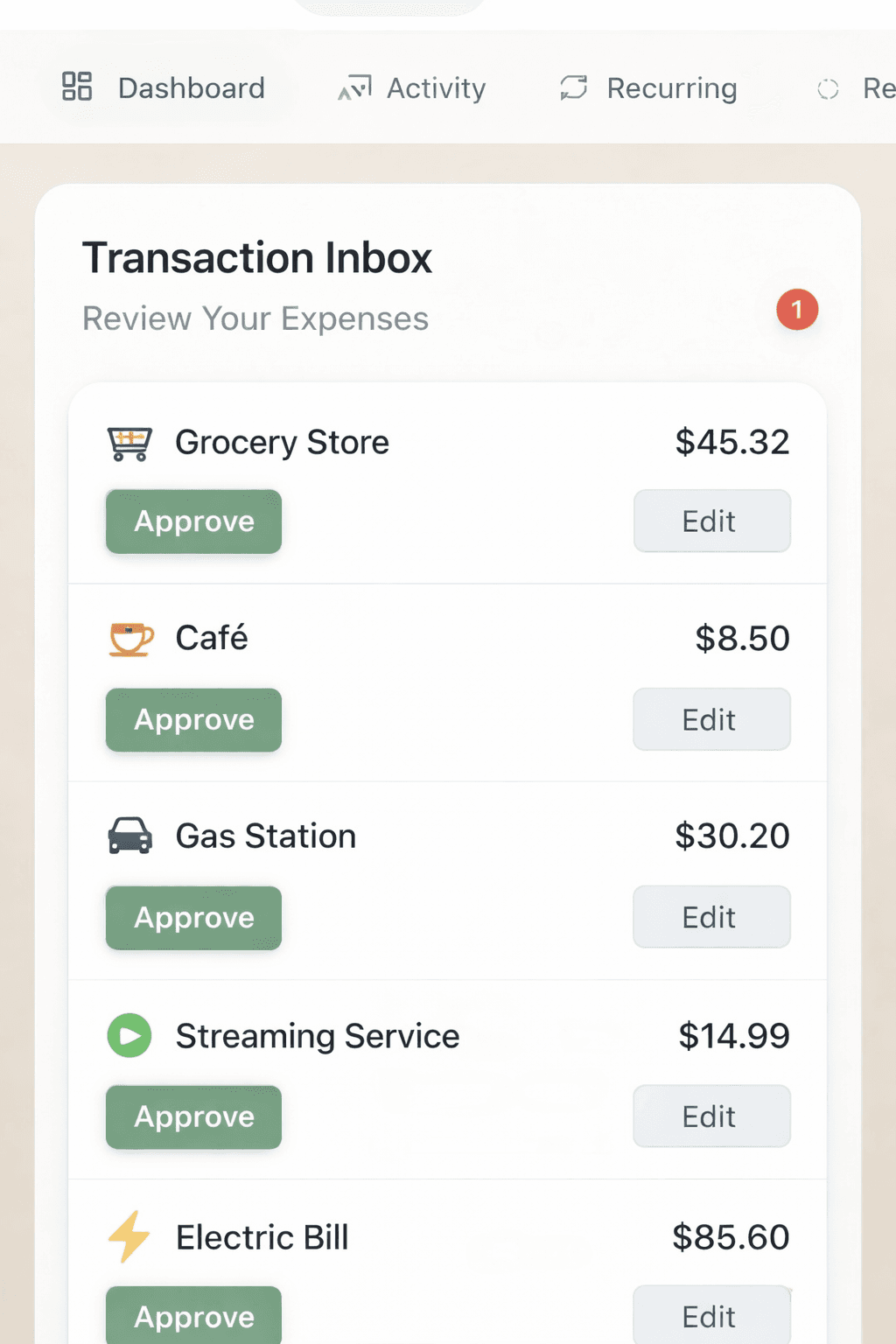

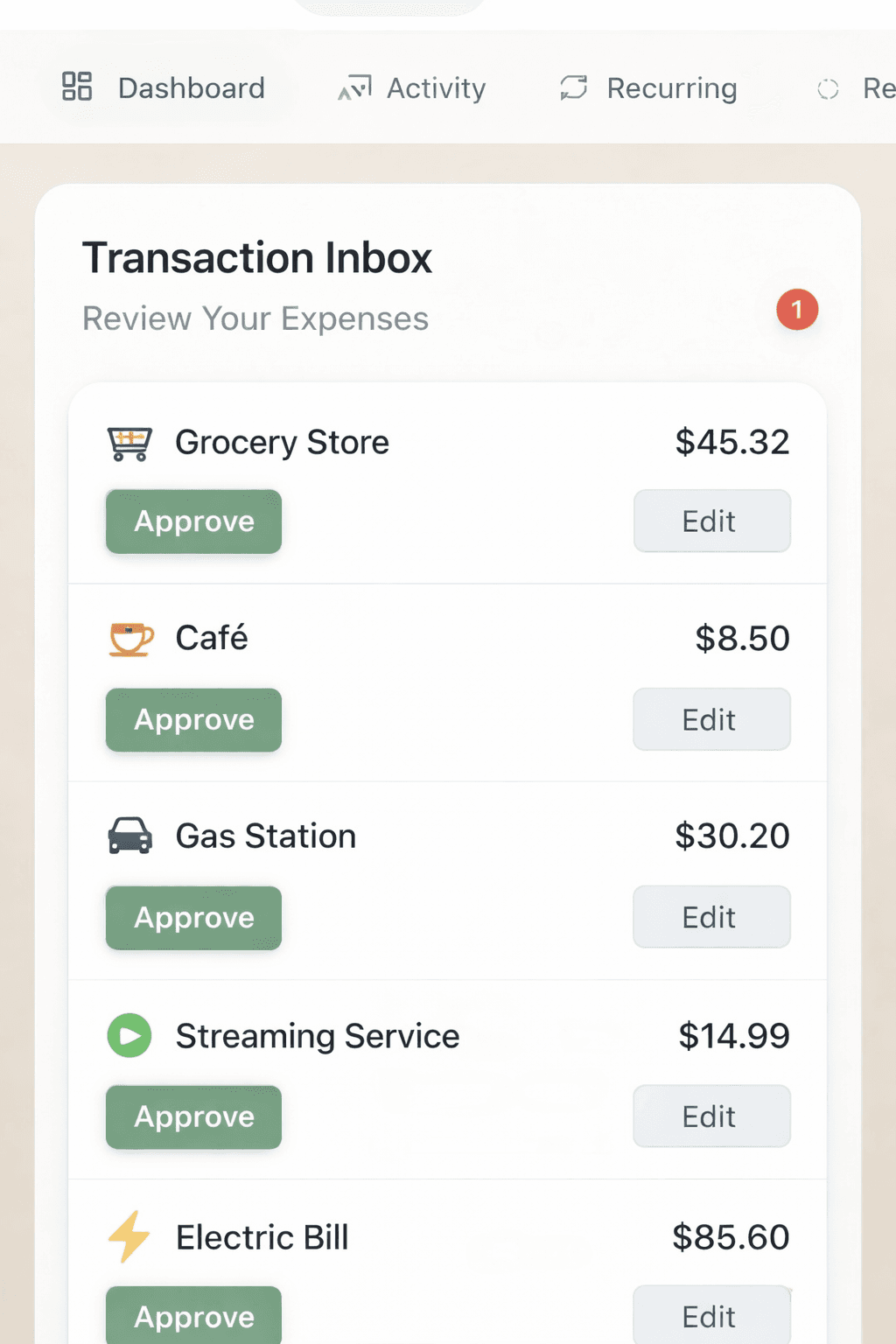

Review

Smart inbox surfaces transactions that need your attention.

Plan

Recurring detection and forecasting turn data into decisions.

The Problem

The benefits landscape is fragmented

Most personal finance apps either rely on aggregation and guesswork (leading to wrong categories and users who stop trusting it), require high discipline (causing burnout), or show what happened without helping with what to do next. People aren't broke from ignorance—they're broke from unclear reality, inconsistent income timing, hidden recurring costs, and decisions made under uncertainty.

Our Solution

Personalized, reality-driven support that scales with you

TallyUp uses manual-first truth capture, a review inbox as a reliability layer, a recurring system as the planning backbone, and decision-shaped insights. Instead of pretty budgets, the focus is reducing false financial confidence by turning messy reality into actionable clarity. Smart categorization, pattern recognition, and context-aware guidance help users see their true spending behavior and make consistently better moves.

Core Capabilities

Our unified platform is built on core pillars that distinguish us

Truth Capture

Manual-first tracking eliminates the guesswork of automated categorization.

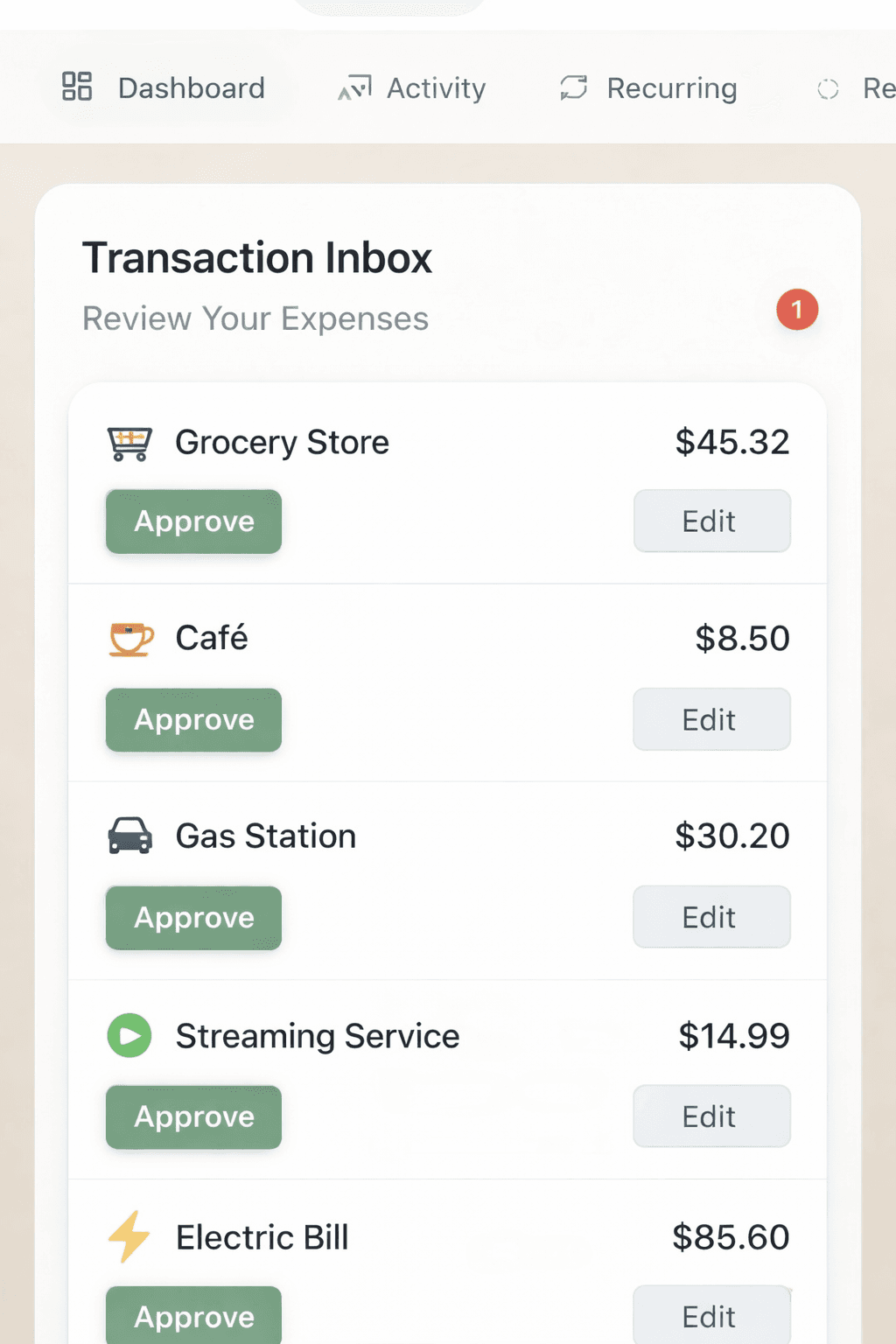

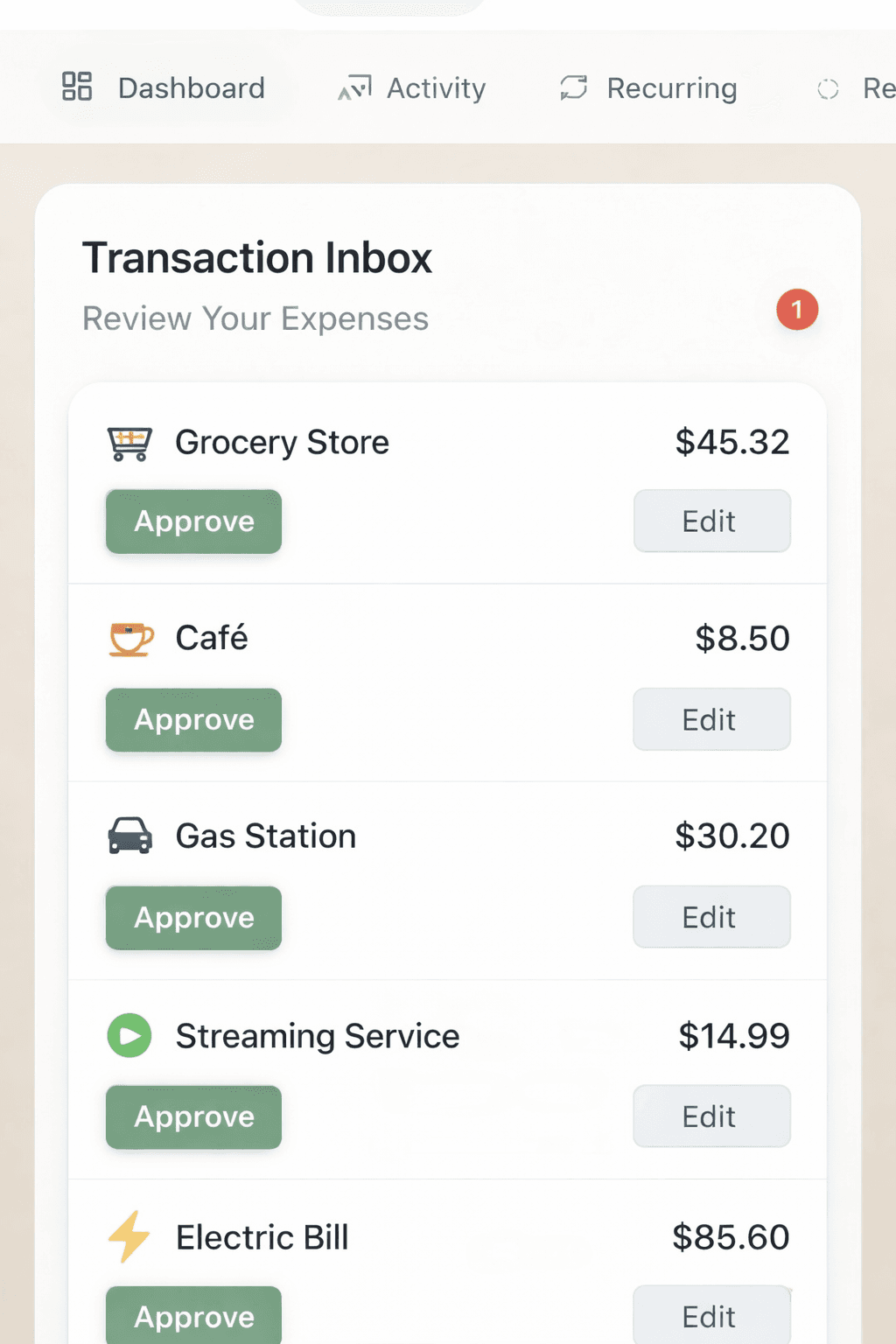

Review Inbox

A reliability layer that surfaces what needs attention, when it matters.

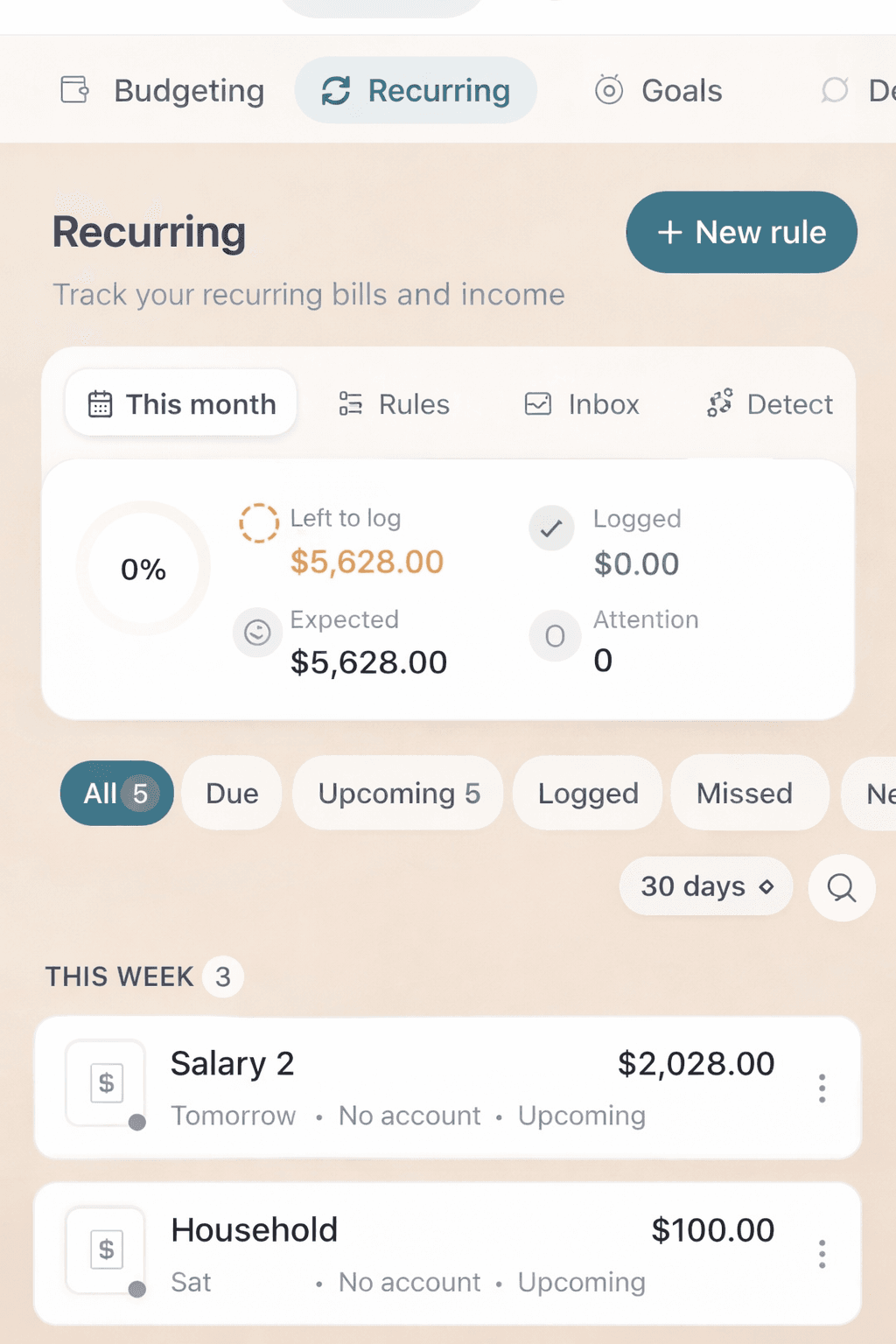

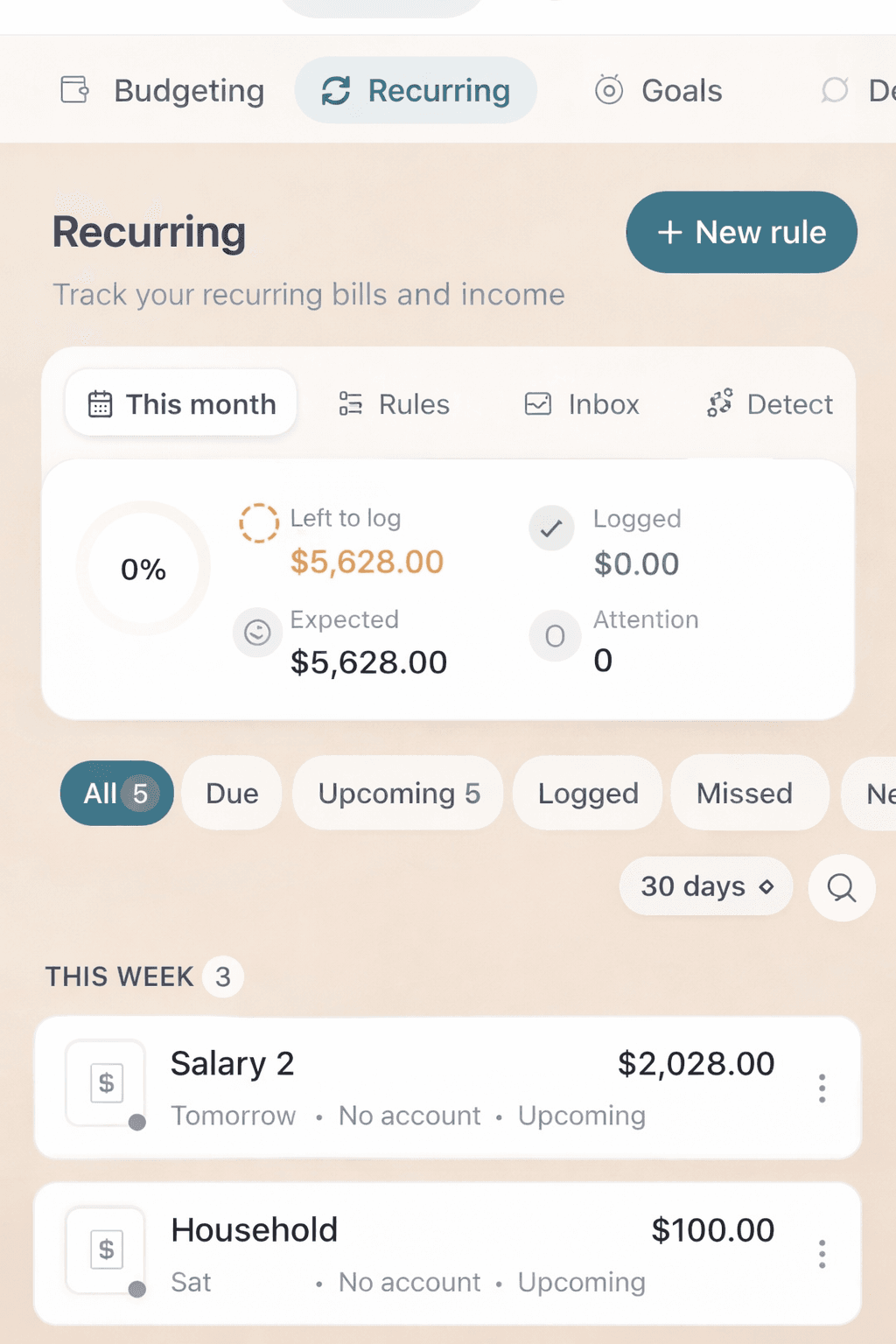

Recurring Engine

Pattern detection builds your planning backbone automatically.

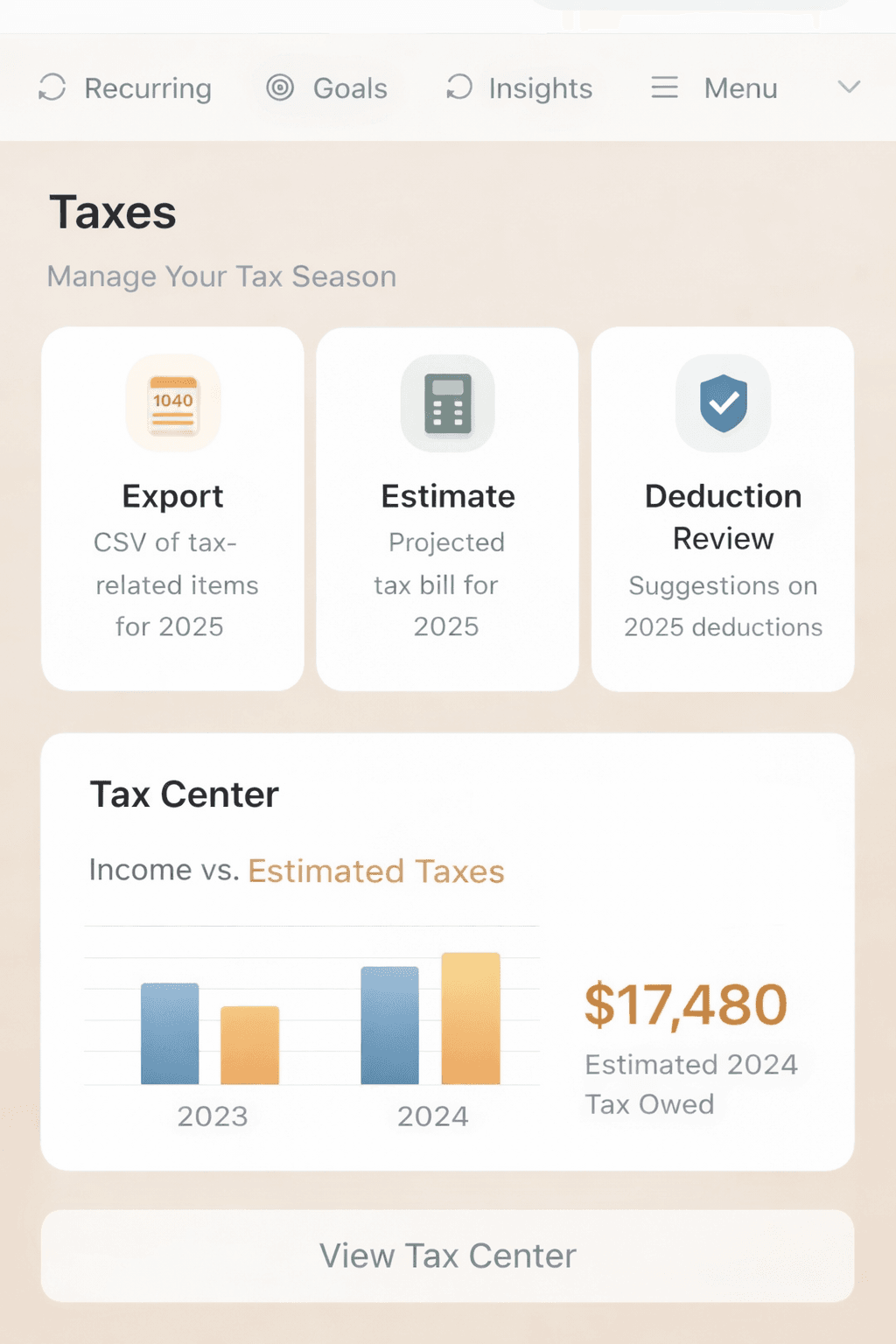

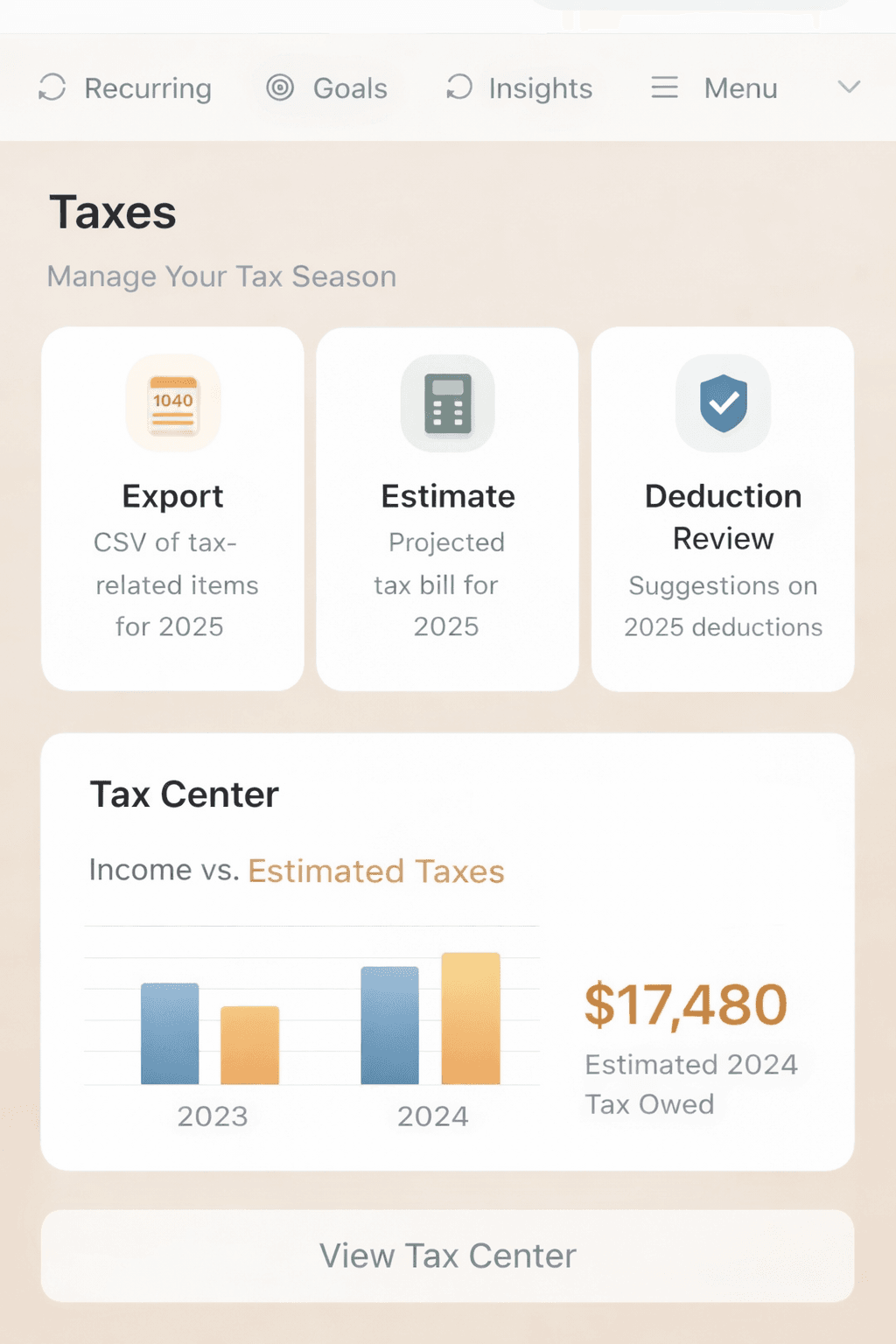

Tax Ready

Documentation and categorization that prepares you year-round.

Product Preview

See TallyUp in action

Review Inbox

Recurring Detection

Tax Readiness

Status & Metrics

Where we are today

250+

Beta Users

$340/mo

Avg. Savings Found

Q2 2026

Launch Target

Built on our values

TallyUp embodies these core Ryze Inc values

Ready to begin with TallyUp?

TallyUp is currently in development. Sign up to get early access and be the first to know when we launch.

Get Early Access

We'll notify you when TallyUp launches. No spam, ever.